- #Quicken vs moneydance for mac

- #Quicken vs moneydance android

- #Quicken vs moneydance software

- #Quicken vs moneydance trial

- #Quicken vs moneydance windows

You can add checking, savings, and credit card accounts and view all your finances in one place. Works on many devices, including web, Android, iOS, Apple Watch, and Amazon’s Alexa. This allows you to plan your budget better for the long run.

You can add checking, savings, and credit card accounts and view all your finances in one place. Works on many devices, including web, Android, iOS, Apple Watch, and Amazon’s Alexa. This allows you to plan your budget better for the long run. #Quicken vs moneydance software

The software aims to help you save every dollar for a specific need. YNAB is another popular personal budgeting software that works on multiple operating systems.

#Quicken vs moneydance trial

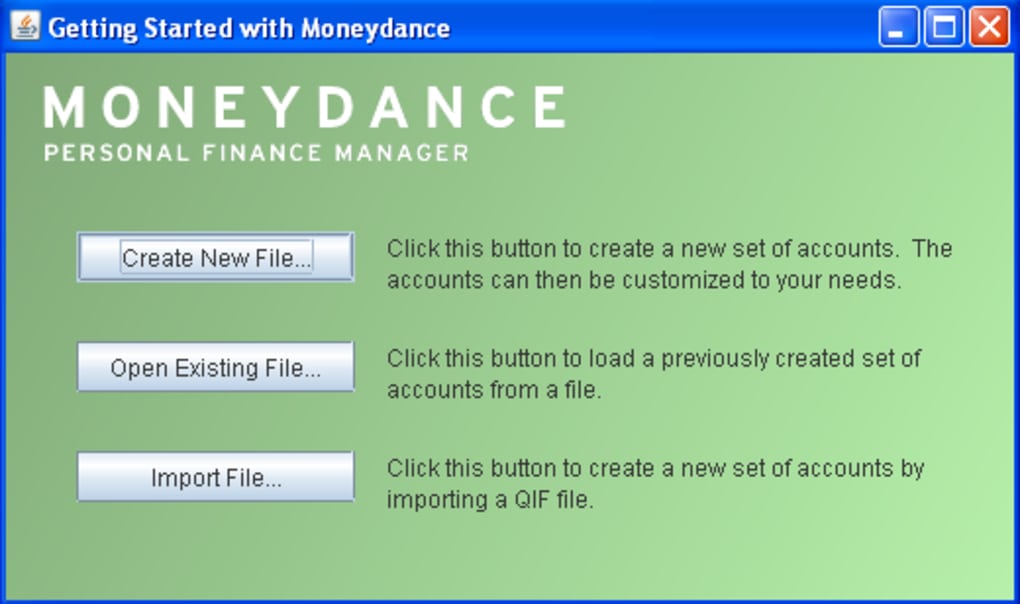

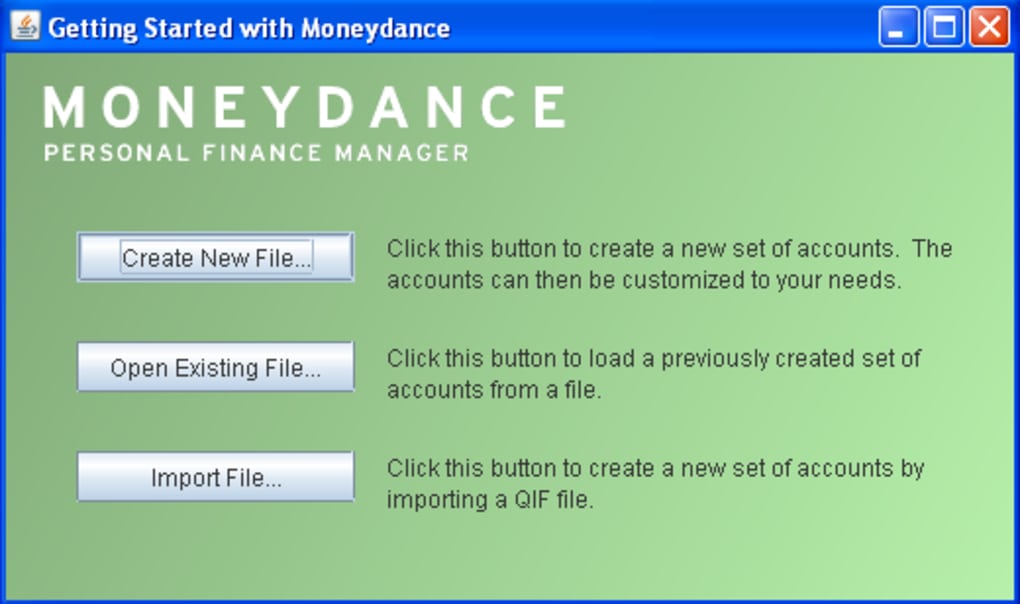

A free trial with limited features is also available.

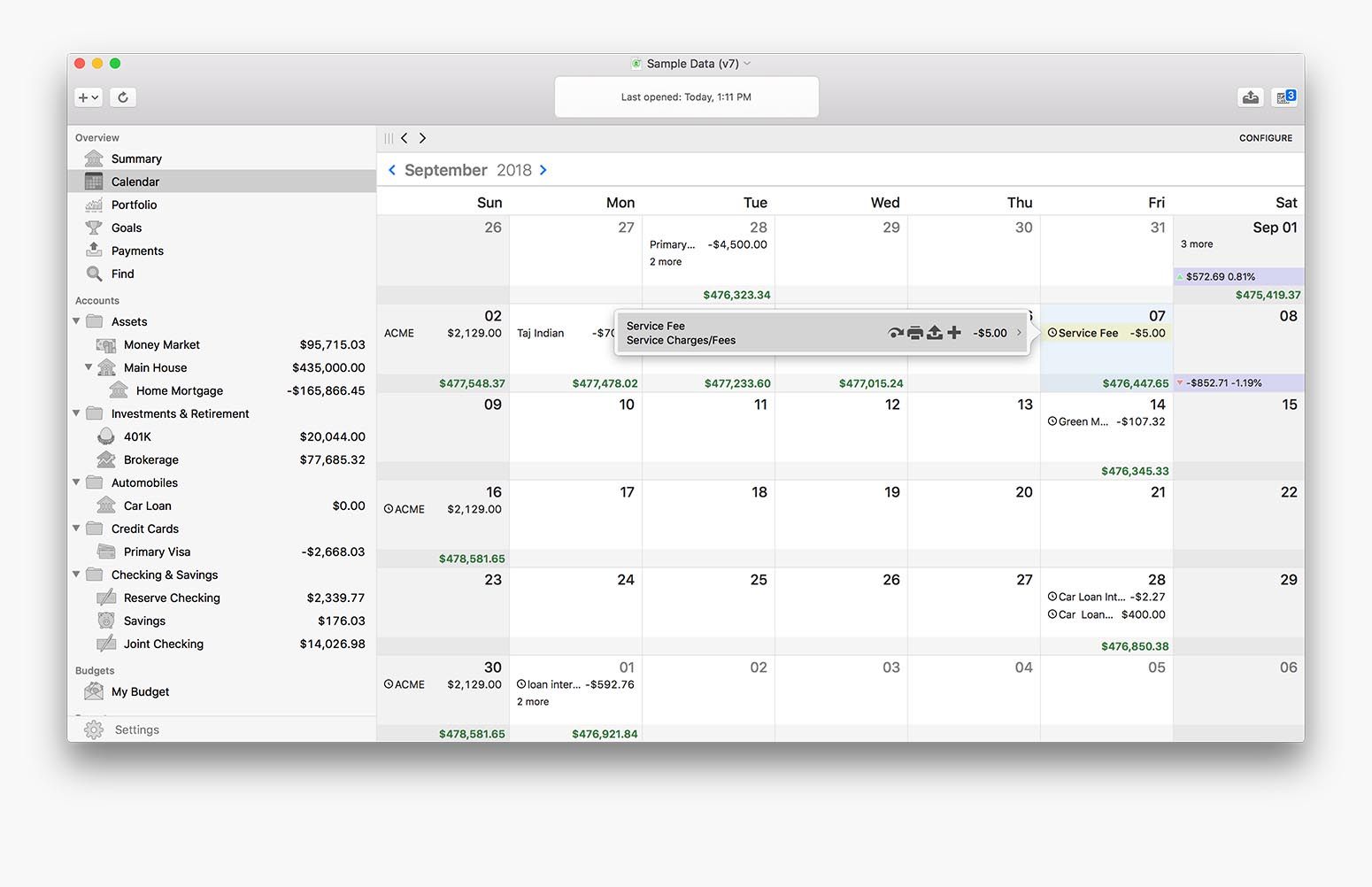

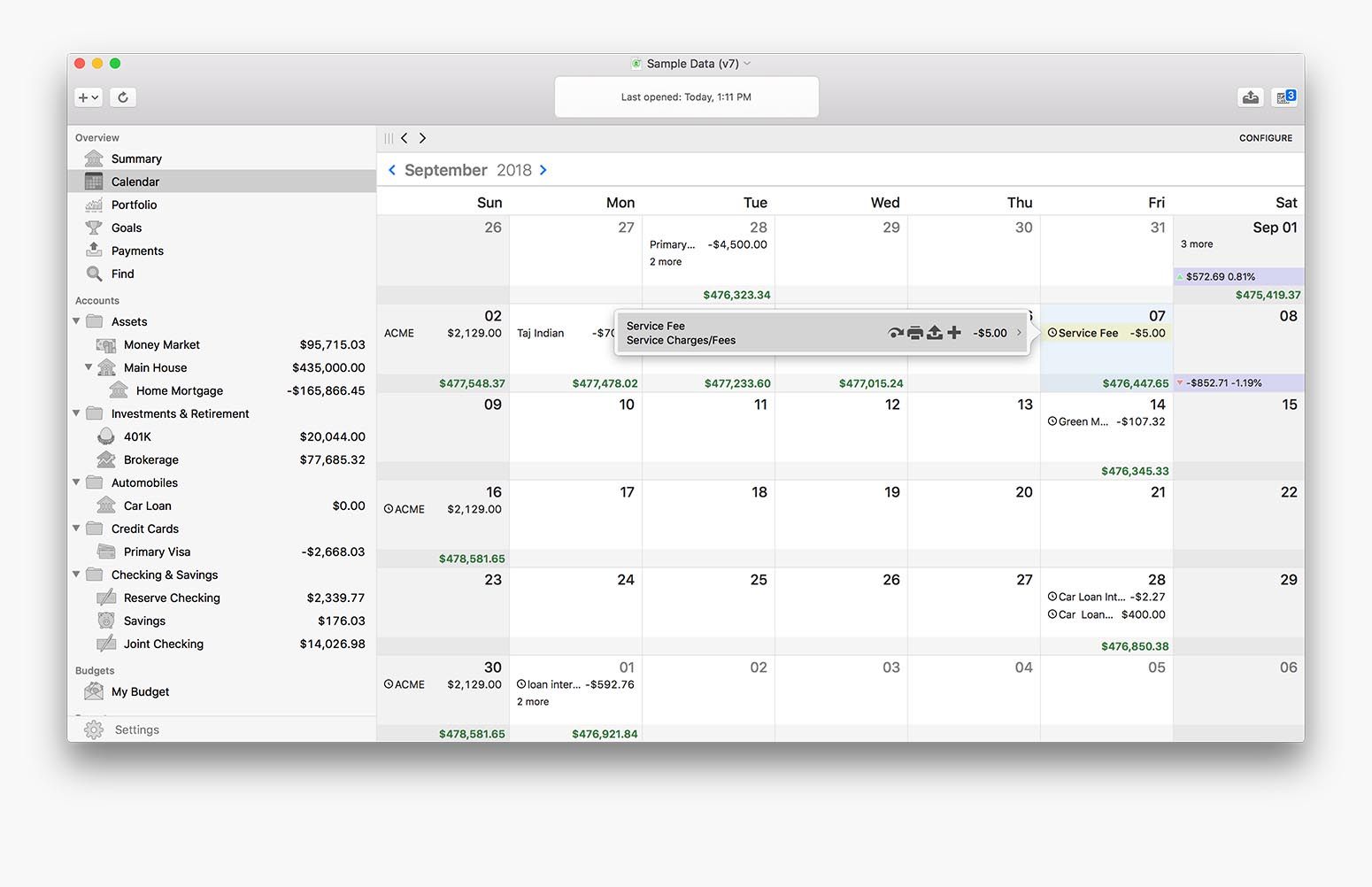

Doesn’t have as many features as the more advanced finance tools.īest Suited for: Non-accountants who want a double-entry bookkeeping system. It lets you set up payment schedules for single and recurring transactions. All your data is represented with easy-to-understand graphs and reports. You can use it to manage finances, track investments, and plan budgets. Software is available for Windows, macOS, and Linux. It uses a double-entry bookkeeping system. Moneydance is a personal finance software that works on several devices and is available in many languages. Pricing: Paid plans are $9.95 and $19.95 per month. It can take some time to understand all features.īest Suited for: Business owners and freelancers who require a personal financing app. The free plan is limited, and paid plans are slightly expensive. You can even import transactions and other data from. Create projections, forecast cash flow, and budget your finances. Connect and send expenses to your Xero account. You can label, categorize and annotate your spending and quickly search for it later. You can view transactions from multiple sources in one place. Connects with 12,000+ institutions worldwide. You connect your financial accounts to it, view the insights, and plan future spending. PocketSmith is a freemium personal finance software. Management fees for paid plans are based on earnings. Paid plans with wealth management features are expensive and require a minimum balance of $100,000.īest Suited for: People earning $100,000+ a year and have an investment portfolio. Access to dedicated financial advisors and an investment committee with the larger plans. Access to financial advisors who will study your finances and develop a plan for you. You can create a budget, track investments and plan your retirement.  You can connect mortgages, loans, credit cards, savings, and 401ks in one place and get a complete view of your money. You also get advice from real financial advisors here. The paid version has wealth management features. It has a good free plan for checking and planning your finances. Personal Capital is a premium financial planning and wealth management app. Not as advanced as Quicken, as it’s a budget planner and spending tracker, not a complete personal finance app.īest Suited for: People looking for a free and straightforward tool to monitor their spending. Mintsights features analyze data to provide personalized insights to help you save more and spend smarter. Multifactor authentication and 256-bit encryption help protect your data. Plan your budget, monitor credit, and track spending with this one tool. It’s not as advanced as Quicken, but it still has a lot of useful features. Mint is a budget planning and spending tracker, which Intuit acquired in 2014. There’s no free plan or trial available, but it has a 30-day money-back guarantee.

You can connect mortgages, loans, credit cards, savings, and 401ks in one place and get a complete view of your money. You also get advice from real financial advisors here. The paid version has wealth management features. It has a good free plan for checking and planning your finances. Personal Capital is a premium financial planning and wealth management app. Not as advanced as Quicken, as it’s a budget planner and spending tracker, not a complete personal finance app.īest Suited for: People looking for a free and straightforward tool to monitor their spending. Mintsights features analyze data to provide personalized insights to help you save more and spend smarter. Multifactor authentication and 256-bit encryption help protect your data. Plan your budget, monitor credit, and track spending with this one tool. It’s not as advanced as Quicken, but it still has a lot of useful features. Mint is a budget planning and spending tracker, which Intuit acquired in 2014. There’s no free plan or trial available, but it has a 30-day money-back guarantee. #Quicken vs moneydance windows

Home and Business, for Windows only, is $95.39 per year. You must pay for the whole year in advance.īest Suited for: Employees, freelancers, and business owners getting started with personal finance.

#Quicken vs moneydance for mac

There’s no Business plan for Mac users. You can access it if you are already a member. One way around this is to use the web version. You have to pay separately for the Windows and Mac apps it will cost more if you use different devices. It has some bugs that slow down the app occasionally. You can also manage your business finances with it. View and manage your bills and plan for the future. Create realistic budgets and saving goals you can stick to. View your banking, credit card, retirement, and investment accounts in one place. #Quicken vs moneydance android

The mobile app is available for iOS and Android devices.

The free Quicken companion mobile app is available for iPad and Android tablets. An easy-to-use financing tool that you can access through the web and via apps. You can also set goals and manage your spending. It helps you view all your financial details in one place. Quicken is for anyone who wants to get their finances in order. You’ve probably heard about Intuit before, as it owns a popular accounting software called QuickBooks. Quicken is a personal financing tool, originally from Intuit, and an independent company since 2016.

0 kommentar(er)

0 kommentar(er)